We have had a few questions come in about what it means to be market and sector neutral vs. “not chasing” the market.

Institutionally, market and sector neutral means you are not taking any outsized bets. On a general basis, this is what that means:

- Market neutral means if a fund uses leverage to be extra-long we would lower the exposure to not having the additional upside exposure. Hedge Funds can use margin to be 125% long, and to be neutral would bring the exposure back to just 100%. In this example a negative view would mean reducing the exposure to below 100%.

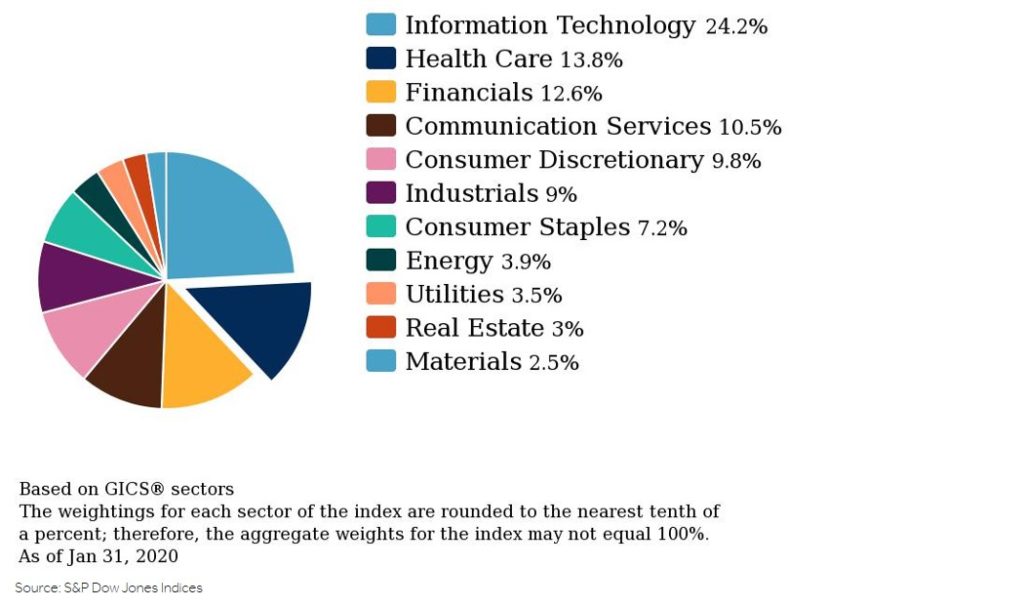

- Sector neutral means not being overweight or underweight any given sector relative to what the Index weight is. For example, according to S&P Dow Jones Indices – a division of S&P Global, as of 01/31/2020, the Health Care Sector was 13.8% of the S&P 500 Index (Figure 1). A neutral position would mean holding that same percentage amount in an institutional portfolio that is measured against the S&P 500 (SPX). Remember that an active institutional fund manager is measured relative to an Index, so a neutral position would be having each sector the same weight as a percentage of what ever Index they are measured against.

Figure 1 – S&P 500 Sector weightings as of 01/31/2020

There is a big difference between “not adding new money” and being “market and sector neutral.”

“Not Chasing” – Our position since November until 01/20 of “not adding new money” simply meant holding any current overweight market and sector exposures our favored Information Technology, Financial, and Industrial Sectors. So if a manager had 30% of their portfolio in Info Tech, we would hold it and if new money came in to a money manager, we recommended they simply hold it in cash to put to work in our favored sectors on a minor pullback. We still wanted our bullish view to work for us, but didn’t want to add to it if new money came in.

Market and Sector Neutral – Our position since our move to market and sector neutral on 01/20 meant actually reducing any excess market exposure or overweight exposure to any sector. In other words, if a fund that is measured against the SPX held 30% in Information Technology vs. the 24.2% SPX Index weight, we recommend selling enough to be equal to the 24.2% of the Index.

I hope that explains our past and current view.

Past performance is not a guarantee of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

Sign up for more access!

Access additional content across the site when you sign up for an account.