The breakout to a one-year high in the Russell 2000 (RTY) has many wondering if the small cap strength was a sign the market should just ramp higher despite the extended condition and increased optimism. As we mentioned in our “What is” note this morning, we continue to expect a minor and temporary interruption in the equity market upside based on our key tactical indicators. We also believe any 2-5% correction should be aggressively used as an opportunity to add exposure to equities.

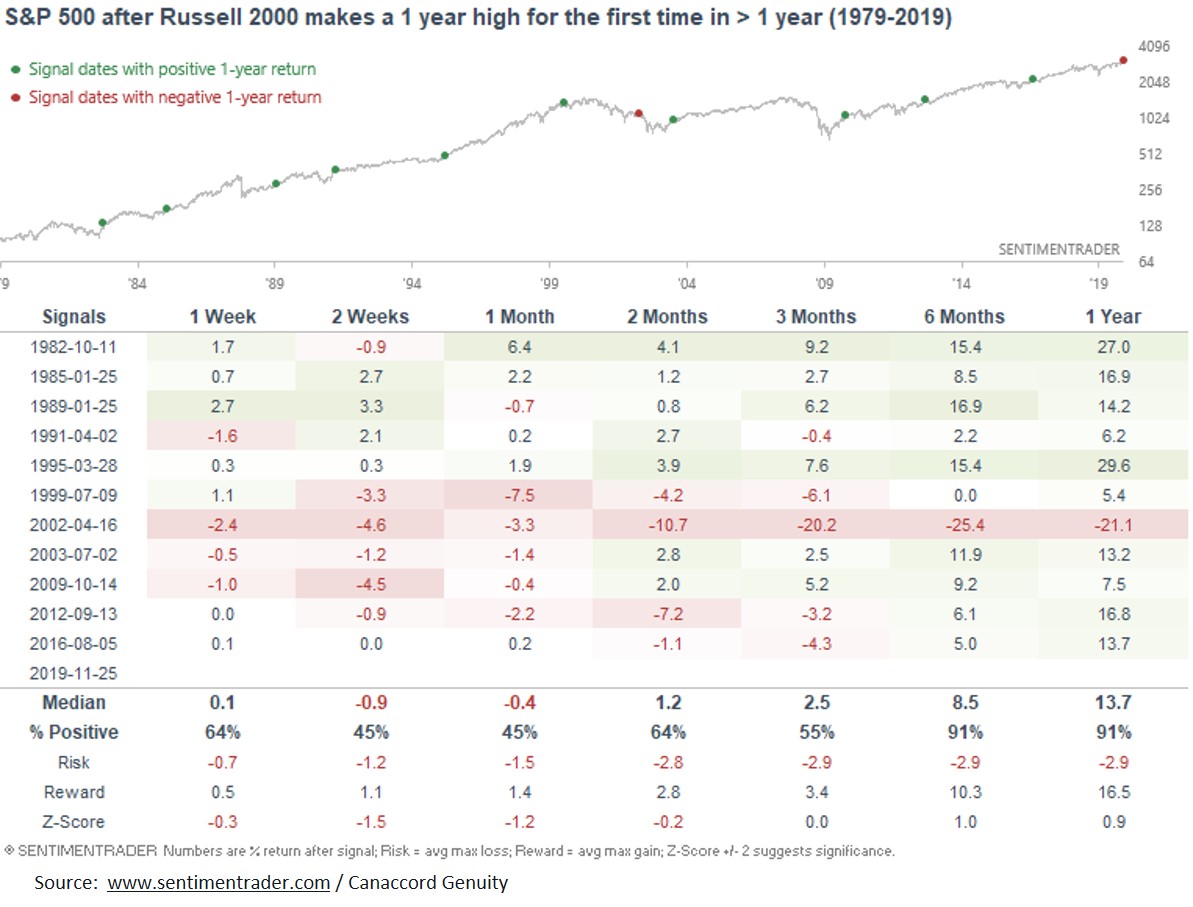

Our “stats dude” answered the question on whether the new 52-week high in the RTY should act as a catalyst to the S&P 500 (SPX). The study below (Figure 1) showed that a breakout to a new high for the first time in a year is an excellent long-term signal, but is a sign of exhaustion over the near-term. In fact, since 1979 we would observe the following:

- There has been a median loss of 0.9% and 0.5% two weeks and a month later, respectively.

- There has only been one gain over the past 20 years two weeks and a month later. A rise of just 0.2% one month out in 2016.

- Outside of 2002, the six and twelve month gains are FANTASTIC.

Our message remains – no need to chase the upside, but we absolutely stand ready to add exposure into any interruption in the upside.

Figure 1 – RTY breakout reinforces buying any pullback in the SPX

Past performance is not a guarantee of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. All data points are sourced from www.sentimentrader.com as of 11/26/19 unless noted otherwise.

Sign up for more access!

Access additional content across the site when you sign up for an account.